Welcome to our betting guide for the Kelly Criteria System. The Kelly Criteria is a mathematical formula that assists in determining the ideal amount to gamble on a certain wager to optimize long-term profitability. This article will cover the fundamentals of the Kelly Criteria, including how to calculate your Kelly bet and implement it in your personal betting strategy. This tutorial will give essential insights and information on how to enhance your betting utilizing the Kelly Criteria, regardless of your betting experience. Let’s get started!

What is Kelly Criterion?

The Kelly Criterion is a mathematical method used to calculate the appropriate size of a wager or investment to optimize a portfolio’s long-term growth rate. It was initially described in a 1956 study titled “A New Interpretation of Information Rate” by J.L. Kelly Jr. The formula considers the likelihood of winning and the reward of the bet or investment. It helps to limit the danger of financial disaster while increasing the possibility of development. It is frequently employed in gambling, trading stocks and options, and other speculative ventures.

It is also referred to as the Kelly strategy, Kelly’s formula, and Kelly bet.

Professional gamblers and investors frequently utilize the Kelly Criterion to control risk and improve profits. It is a potent tool that may assist you in making better-educated judgments on how much to wager or invest and how to manage your portfolio over time. It is essential to remember, however, that the Kelly Criterion is not a guarantee of success, and that you should always conduct your own research and analysis before making any investment or betting selections. By adhering to the Kelly betting Criteria, you may boost your long-term chances of success and optimize your rewards.

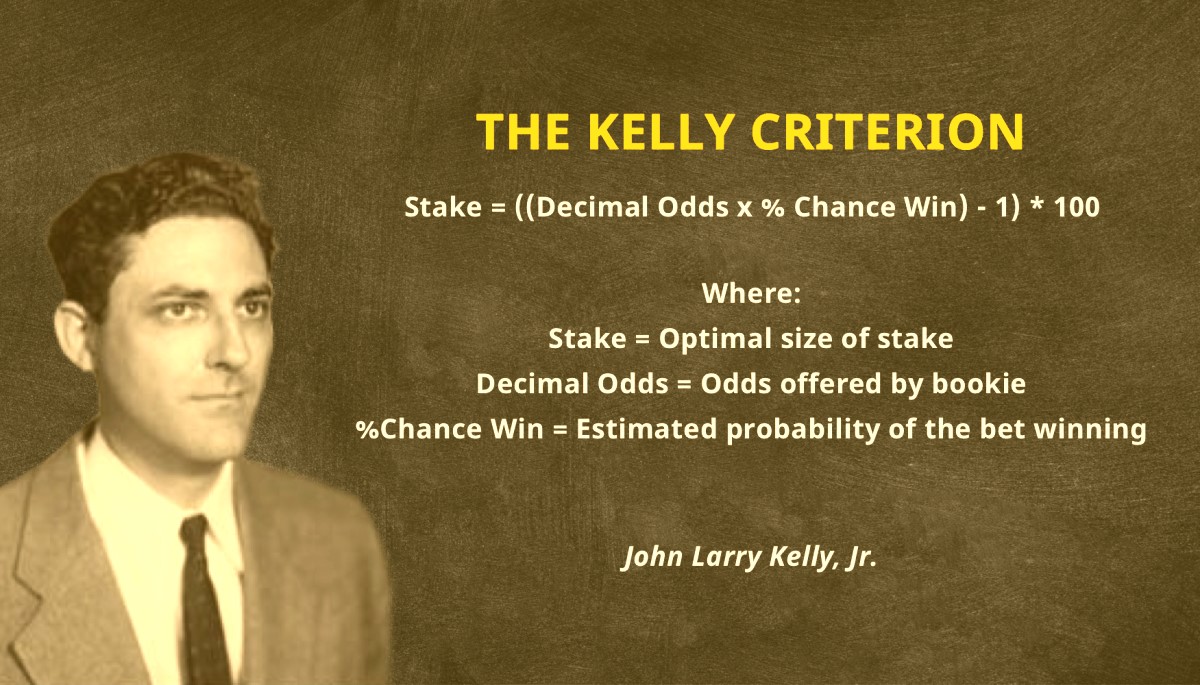

The Kelly Criterion Formula

The Kelly Criterion formula determines the appropriate proportion of a bankroll to wager on a specific gamble. The following is the formula:

fraction of Kelly = (bp – q) / b

where:

- b = the net payout odds on the wager (i.e., the payout minus the initial stake)

- p = the possibility of winning the bet

- q = the possibility of losing the bet (usually 1 minus p)

The Kelly fraction indicates the proportion of the bankroll that should be gambled on the subsequent stake. If a bettor employs the Kelly’s formula, the size of their wagers will be adjusted proportionally to the Kelly fraction. For instance, if the Kelly fraction is 0.1, the next wager should represent 10% of the bankroll.

The Kelly betting Criterion is a long-term strategy that implies the player has an endless bankroll and an indefinite period of time. The Kelly Criterion method is only sometimes applicable in the real world, as it may lead to wagering more than you can afford. It must be used with prudence and with consideration for one’s own finances.

How the Kelly Criterion works in sports betting

The Kelly bet may be used for sports betting like other forms of gambling and investment. The fundamental concept is to apply the formula to find the ideal size of a wager based on the probabilities of winning and the payoff associated with the wager.

The initial step in applying the Kelly Criterion to sports betting is to compute the net odds obtained on the stake. This is accomplished by deducting the original wager from the payoff for the wager. If the odds of winning a wager are 2-to-1 and the initial wager is $100, the net odds obtained would be $200 ($300 payoff minus $100 investment).

Next, the chance of winning the wager must be calculated. Typically, this information may be discovered on betting websites or through research. For instance, if a team had a 50 percent chance of winning a game, the probability of winning the wager would be 0.50.

Once these values are obtained, the Kelly betting formula may be applied to find the best proportion of the bankroll to gamble on the stake.

For instance, if the net odds obtained are $200, the probability of winning is 0.5, and the likelihood of losing is 0.5, then the Kelly fraction is (0.5 * 200 – 0.5) / 200 = 0.25, or 25%.

How to Use Kelly’s Criterion in betting

The Kelly Criterion can be a valuable tool for risk management and return optimization in sports betting, but it is not a one-size-fits-all approach. The following procedures will assist you in using Kelly’s Criterion while betting:

- Determine the net odds on the wager received: This is accomplished by deducting the original wager from the payoff for the wager.

- Calculate the probability of winning: This information is often available on the betting website or through independent research.

- Use the Kelly Criterion calculation to determine the ideal wagering percentage of your bankroll.

- Use the Kelly system betting as a guide, rather than as a rule: Remember that the Kelly Criterion is a long-term strategy that implies a limitless bankroll and time. Use it as a suggestion, not a rule, and be willing to change your wager size based on your bankroll and risk tolerance.

- Maintain a record of your progress: Keep track of your wagers, victories, and defeats, and use this data to improve your betting strategy over time.

- Utilize the Kelly criteria as part of a larger plan: The Kelly Criterion is only one component of a comprehensive betting strategy. It should be considered with other criteria, such as a study of the game, teams, players, and other pertinent data.

- Be cautious: The Kelly Criterion is a potent instrument, but it is not a guarantee of success. Always utilize it with prudence, keeping in mind your resources and risk tolerance.

By following these steps, the Kelly Criterion may be used to improve your betting strategy and raise your chances of long-term success.

Kelly Criterion Example in Sports Betting

Here is an example of the application of the Kelly Criterion to a sports betting scenario:

Suppose you are considering placing a wager on a football game in which your team has 3-to-2 chances of winning. This implies that for every $2 wagered, you will receive a $3 return if your team wins. Your first wager will be $100.

First, we must determine the net odds on the stake, which are (3-2) = $1.

Next, we must assess the likelihood of winning by conducting research or contacting a betting professional. Let’s assume that the likelihood of your team winning is 0.55 or 55% based on the team’s recent performance and other considerations.

Now, we can use the Kelly betting formula to calculate the optimal fraction of the bankroll to wager on the bet:

- Kelly fraction = (bp – q) / b

- Kelly fraction = (0.55*1 – 0.45) / 1 = 0.11 or 11%

- So, based on the Kelly Criterion, the optimal amount to bet on this game would be 11% of your bankroll, which in this case is $11.

The Kelly Criterion is a potent instrument for minimizing risk and maximizing returns in sports betting, but it is not always the best option. Here are some situations in which the Kelly Criterion may be most appropriate:

When it's best to apply the Kelly Criterion

When you have a long-term perspective:

The sports betting Kelly Criterion is a long-term strategy assuming an endless length of time and an infinite bankroll. When you have a long-term view and are ready to ride out short-term changes to optimize long-term gains, you should utilize this strategy.

When you have a high level of confidence in your predictions:

The Kelly Criterion is based on the chance of winning, hence it is most useful when you have great confidence in your forecasts. When uncertain about the result of a wager, it may be prudent to choose a more conservative betting approach

When you have a large bankroll:

The Kelly Criterion betting system may lead to enormous bets, thus it is best utilized when you have a substantial bankroll and can afford to make significant bets without putting your finances at risk.

The Kelly Criterion betting system may lead to enormous bets, thus it is best utilized when you have a substantial bankroll and can afford to make significant bets without putting your finances at risk.

The Kelly system betting can result in substantial wagers and severe volatility, thus it is best utilized by people with a moderate to high risk tolerance. If you are risk-averse, you should probably choose a more conservative betting approach.

When you have a strong grasp of the game:

The Kelly Criterion algorithm is based on the probabilities of winning and the payment, thus it is most effective when you have a thorough grasp of the game and can anticipate the odds of winning precisely.

Is it worth using the Kelly Criterion in betting?

Whether or not it is advantageous to use the sports betting Kelly Criterion depends on the circumstances and preferences of the individual. Here are a few considerations:

- The Kelly Criterion is a mathematical method used to estimate the ideal amount to gamble on a certain wager to maximize long-term profitability. It is a tried-and-true method employed by professional gamblers and investors.

- When the chance of winning a bet or the payoff is accurately known, the Kelly Criterion can be useful. In situations where the likelihood of success is unknown, the Kelly criterion may not be as successful.

- Using the Kelly Criterion might be dangerous because it can lead to wagering above one’s means. When using it, it is vital to exercise prudence and evaluate your financial situation.

- The Kelly Criterion sports betting is a long-term strategy that assumes a limitless bankroll and time. It may not be the greatest choice for short-term or limited-duration wagers.

- The Kelly bet should be employed as part of a larger plan, alongside other factors such as the analysis of the game, the teams, the players, and other pertinent data.

Here are some advantages and disadvantages of employing the Kelly Criterion:

Pros and Cons of the Kelly Criterion

The Kelly Criterion is meant to optimize a portfolio’s long-term growth rate, which can result in better returns over time.

The Kelly Criterion serves to reduce the danger of financial disaster by altering the size of bets based on the likelihood of winning and the payment.

The Kelly’s Criterion gives a straightforward and tangible technique for minimizing risk and maximizing rewards.

The Kelly Criterion sports betting method is basic and straightforward, making it accessible to a wide spectrum of individuals.

The Kelly Criterion betting system presupposes an endless length of time and a limitless bankroll, both of which are unrealistic in practice.

The Kelly Criterion can result in big wagers, which can be dangerous and may not be suited for all investors.

The Kelly Criterion is not a guarantee of success, and it is essential to conduct your own research and analysis before making any investment or wagering decisions.

The Kelly Criterion can lead to big wagers and high volatility, therefore it is not appropriate for persons with limited risk tolerance.

FAQ

The Kelly bet can be applied to sports betting by finding the net odds received on the wager, calculating the chance of winning, and then calculating the best proportion of the bankroll to wager on the wager using the Kelly Criterion calculation. Keep in mind that the Kelly Criterion is a long-term strategy, and it presupposes a limitless bankroll and an endless amount of time, therefore it should be utilized with prudence and personal finances and risk tolerance should always be considered.

The Kelly Criterion is a mathematical method used to calculate the appropriate size of a wager or investment to optimize a portfolio's long-term growth rate. It takes the chance of winning and the payment of the bet or investment into consideration and helps to limit the risk of financial disaster while maximizing the possibility for growth. It is frequently employed in gambling, trading stocks and options, and other speculative investments.

As a mathematical formula, the Kelly Criterion betting system is not prohibited. However, it is crucial to examine the laws and regulations of your local country or region to ensure that sports betting is permitted.

The Kelly’s Criterion can be a valuable tool for risk management and return optimization in sports betting, but it is not a one-size-fits-all approach. It is crucial to take caution and evaluate your finances and risk tolerance when employing it since it is not a guarantee of success. It is also crucial to employ it as part of a larger strategy and to recognize its limitations.

The Kelly bet is a well-established approach employed by professional gamblers and investors, and it can be beneficial when the likelihood of winning a wager or the payout is accurately known. However, it is not a guarantee of success, so you must use it with prudence and evaluate your budget and risk tolerance. It is also crucial to use it as part of a larger strategy and to recognize its limitations.

Last updated on 15 Feb 2023 - 21:01